Trading Bots - Automate Your Crypto Trades for Maximum Gains

Introduction: What Are Crypto Trading Bots?

Crypto trading bots are automated software programs designed to execute trades on behalf of users based on predefined strategies. These bots analyze market trends, execute trades faster than humans, and operate 24/7 without the need for constant monitoring.

Who Should Use Trading Bots?

- Advanced traders looking to automate strategies

- Investors wanting to capitalize on market volatility

- Users with coding knowledge to create custom bots

Types of Trading Bots

1️⃣ Arbitrage Bots

These bots take advantage of price differences between exchanges, buying low on one and selling high on another.

Example: Buying BTC on Binance for $45,000 and selling on Coinbase for $45,500.

2️⃣ Market-Making Bots

These bots continuously place buy and sell orders to profit from small price fluctuations.

Risk: Highly competitive and can lead to losses in low-volume markets.

3️⃣ Trend-Following Bots

Use indicators like Moving Averages and RSI to identify trends and execute trades accordingly. Best for bullish or bearish market trends.

4️⃣ Grid Trading Bots

Set up buy and sell orders at specific price levels, making profits from sideways markets. Ideal for volatile, ranging markets.

5️⃣ Scalping Bots

Make multiple small trades within seconds to capture tiny price movements.

High risk but can be highly profitable.

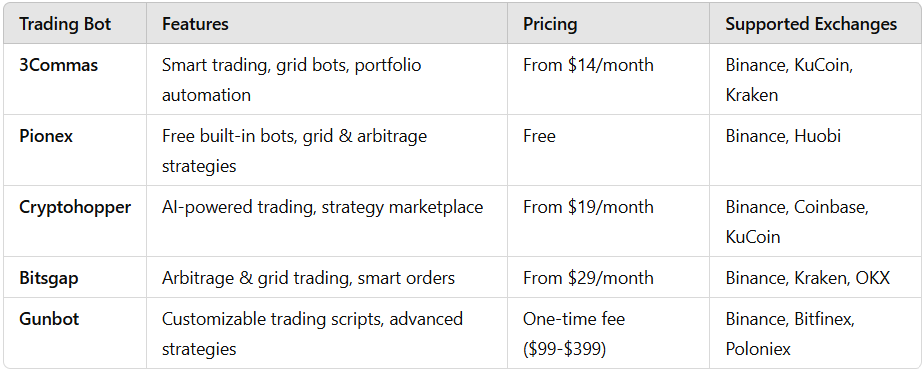

Best Crypto Trading Bots (2024)

Here are some of the top trading bots used by expert traders:

Pros & Cons of Using Trading Bots

✅ Advantages:

✔ 24/7 automated trading

✔ Faster execution than humans

✔ Eliminates emotional trading

✔ Can backtest strategies

❌ Disadvantages:

✖ Requires technical knowledge

✖ Market conditions can change unpredictably

✖ Risk of API key misuse (security risk)

✖ Some bots require expensive subscriptions

How to Set Up a Trading Bot

1️⃣

Choose a bot – Select one based on your needs (e.g., arbitrage, scalping, trend-following).

2️⃣

Connect to an exchange – Provide API keys (always disable withdrawal permissions!).

3️⃣

Select a trading strategy – Set indicators like RSI, MACD, Bollinger Bands.

4️⃣

Backtest your strategy – Test it on past market data to see performance.

5️⃣

Deploy with small capital – Always start with a small amount before scaling up.

Where to Get Crypto Trading Bots?

There are various platforms where you can find crypto trading bots. Some bots are free, while others require a premium subscription or a one-time purchase. Here are the best places to find crypto trading bots:

1️⃣ Official Websites & Marketplaces

✅

3Commas –

3commas.io (Paid, user-friendly)

✅

Pionex –

pionex.com (Free built-in bots)

✅

Cryptohopper –

cryptohopper.com (Paid, AI-powered)

✅

Bitsgap –

bitsgap.com (Advanced features)

✅

Gunbot –

gunbot.com (One-time license, fully customizable)

2️⃣ Open-Source Trading Bots (For Developers)

If you are a developer and want to code your own strategies, you can use open-source trading bots:

✅

Freqtrade –

GitHub (Python-based, free)

✅

Gekko –

GitHub (Node.js, easy to use)

✅

Zenbot –

GitHub (Supports high-frequency trading)

3️⃣ Crypto Exchanges with Built-In Trading Bots

Some crypto exchanges offer their own automated trading tools:

✔ Binance – Grid trading, spot & futures bots

✔ KuCoin – Free spot grid and DCA bots

✔ OKX – Smart trading and arbitrage bots

✔ Bybit – Trading bots for futures

4️⃣ Bot Marketplaces (Buy & Sell Strategies)

Some platforms allow users to buy bots from other traders or share strategies:

🔹

Cryptohopper Marketplace – Buy ready-to-use strategies from other traders

🔹

3Commas Marketplace – Purchase trading signals and bot configurations

🔹

TradingView Scripts – Use custom Pine Script strategies and connect them to bots

📌 Pro Tip: Always test a bot in demo mode before using real money. Choose a trusted source and make sure the API access does not allow withdrawals to prevent hacks!

Are Trading Bots Worth It?

For advanced traders, bots can enhance profits, automate strategies, and eliminate emotional bias. However, they require constant monitoring and adjustment. Beginners should avoid trading bots until they understand market behavior.

Final Thoughts

Crypto trading bots are powerful tools, but they require deep market knowledge, proper strategy setting, and risk management. If used correctly, they can be a game-changer in crypto trading.

📌 Tip: Always start with a demo account or small capital before deploying large funds with a trading bot!

Nieuwe alinea